TLDR — Translucent is building the first AI-powered financial platform designed exclusively for healthcare operators at medical groups and health systems. We are thrilled to lead Translucent’s $7M oversubscribed seed round alongside our colleagues at NEA and FPV, with participation from Redesign Health, and to partner with Translucent co-founders Jack and Max in their 0 → 1 phase.

Problem: Traditional Healthcare FPA is Reactive & Siloed

##Problem

Hospitals and physician groups drive $2.5T in medical expenditures annually and operate at 2-5% operating margins. At this scale, even a 1-2% absolute operating margin improvement is substantial ($25B-$50B) for healthcare providers across the country.

Imagine a VP of Operations that oversees $200M in revenue across surgical services that lacks real-time visibility and struggles to interpret complex “finance-formatted” data (P&L, GL, etc). This VP understands clinical operations, but lacks financial expertise or data engineering skills. Because of this, operators at medical groups and health systems are reactive and struggle to answer strategic questions that are core drivers of their financial health, such as:

- Who were the top performing and lowest performing physicians on a wRVU basis compared to national benchmarks?

- What was the profitability of the chemistry service in laboratory last month? How does that compare to the same month last year?

- What were the biggest expense drivers for Cardiology last month? How does that compare to YTD trends?

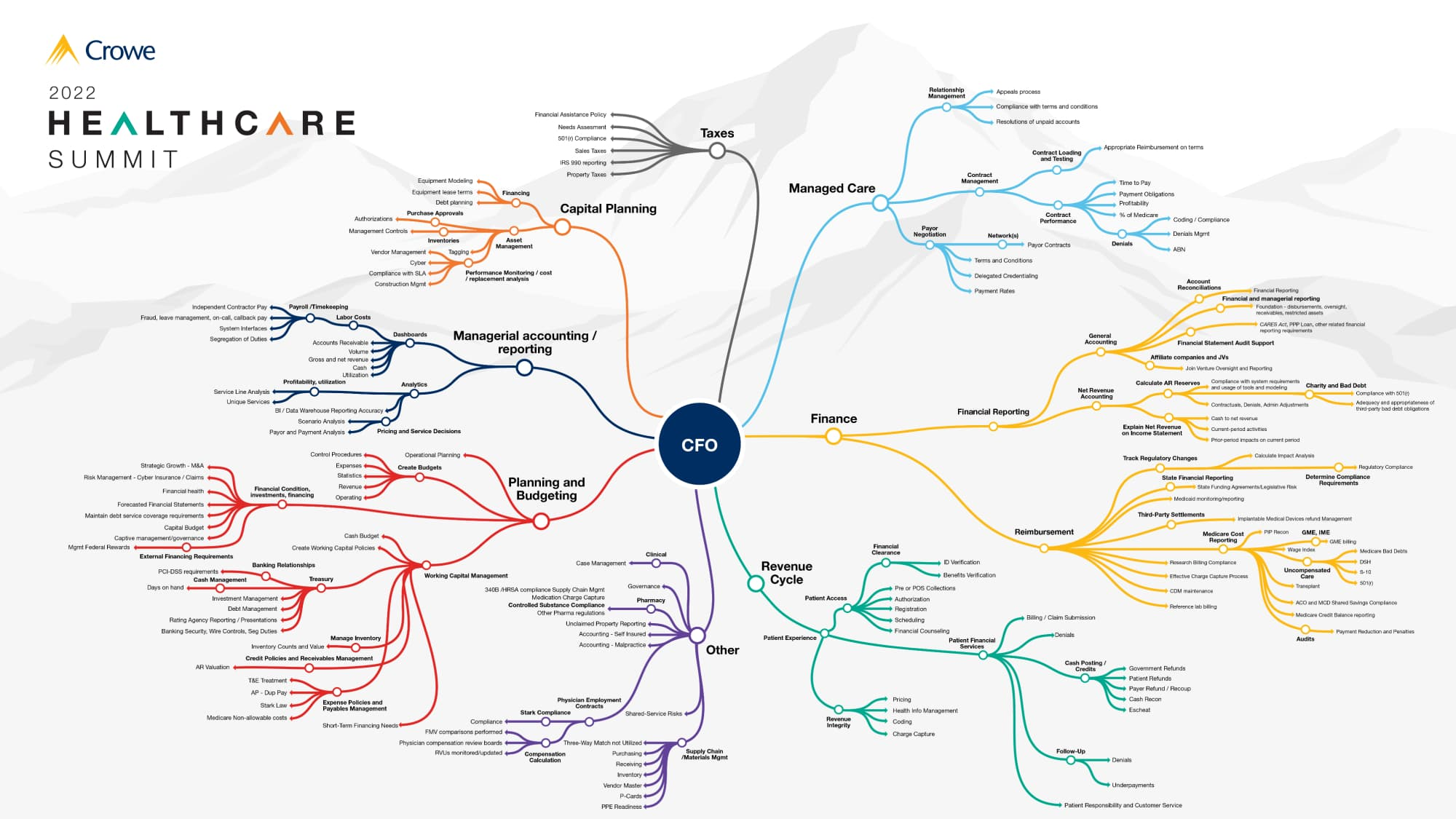

Hiring financial analysts for every service line to support these operators is unsustainable. Even if you could, data silos and broken processes are the real problem. Too often, providers’ profit-and-loss (P&L) statements do not provide enough detail to estimate what is necessary and unnecessary spending. Even when they do, the data are not broken down in a way that mimics how the organization operates. FPA work is significantly more complex in healthcare and general FPA solutions are ineffective. A typical CFO might be concerned with closing the books efficiently, forecasting revenue, and consolidating financial statements. A healthcare CFO must do all that while also managing reimbursement contracts from multiple payers, complying with state and federal healthcare regulations, tracking patient billing, and overseeing complex revenue cycle processes.

These data silos mean FPA teams are spending >80% of their time wrangling data. During our conversations with health systems and medical groups, we saw an FPA team at one medical group overlook $4M in pharmacy rebates because it would have required them to manually reconcile and integrate data from pharmacy, the EMR, payer contracts, and GPO contracts. At another $5B revenue health system, it took a month to answer questions on market share for 2 AICs the system was acquiring because people were emailing around files for PSAs and MSAs, physician comp, GPO rebates, and billing codes. Another medical group was paying $1M+ per year to have 5 FTEs with a custom dashboard exclusively track physician compensation in 7 excels.

Enter Translucent

##Enter Translucent

Translucent gives every department and service line a 24/7 AI Financial Analyst with healthcare expertise and financial acumen that understands your specific business logic and is integrated with all your data. Healthcare operators leverage a simple chat-based interface to get answers to financial questions, prepare financial analyses, and collaborate and share insights to drive decision-making.

Under the hood, Translucent has built an enterprise agentic AI software platform that integrates specialized models, fine-tuned agent workflows, and evaluations & issue resolution capabilities to expand the flexibility of their AI Agents without compromising financial accuracy. In a matter of weeks, Translucent integrates with a customer’s data warehouse, builds a data model with customers’ business logic, and then has a reasoning loop that marries LLM chat-based queries to the right Python/SQL script for calculations on that data model.

Team: Founder Product-Market Fit

##Team

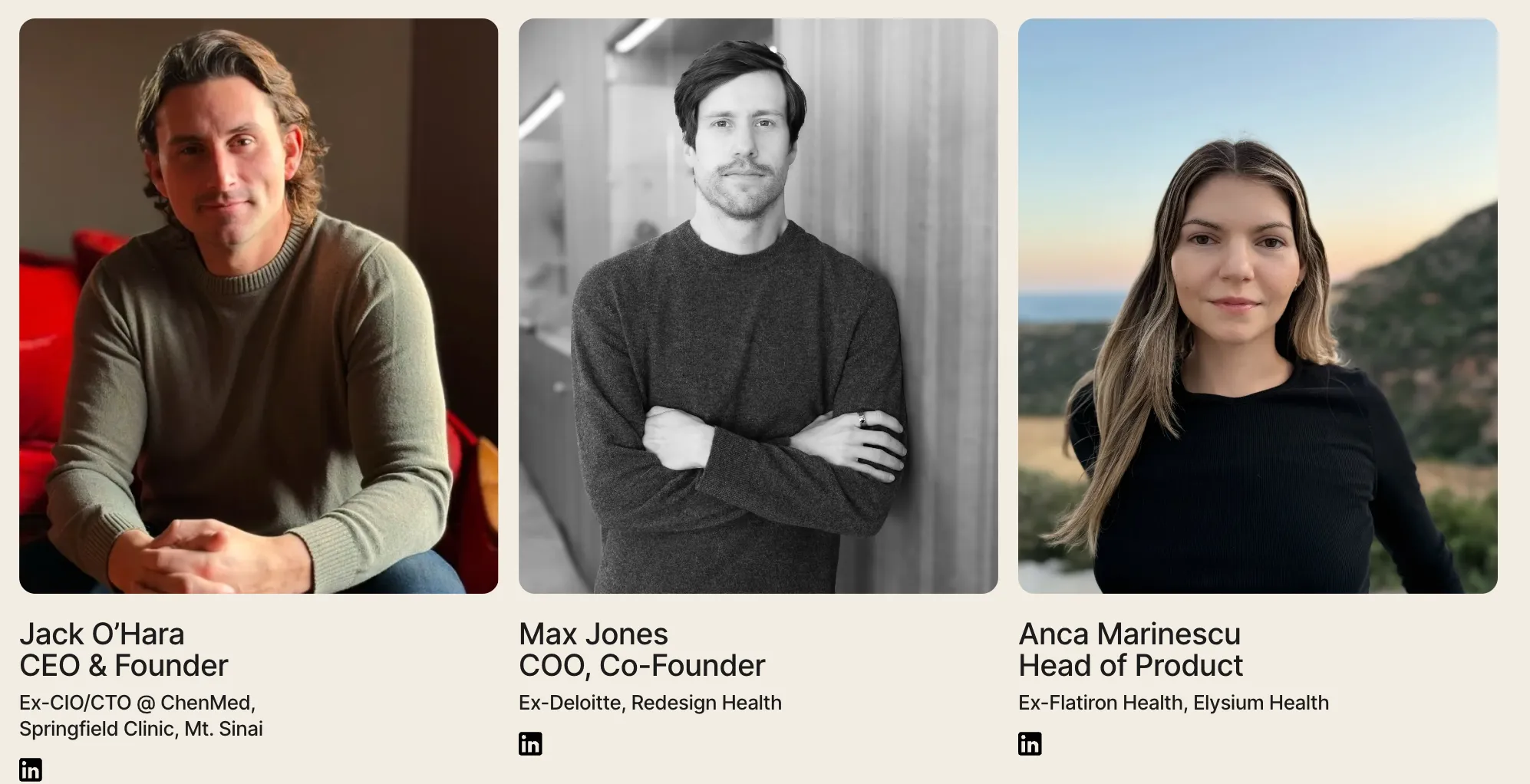

The Translucent management team has a unique blend of healthcare, financial and technical DNA that we view as crucial for building the first AI-powered financial platform designed exclusively for healthcare operators. While ‘technical AI native’ founders are highly sought after, in healthcare, we place equally if not more importance on the depth of domain expertise, context understanding and end-user UX/UI that founders addressing enterprise healthcare challenges must be armed with. Jack O’Hara, Translucent Co-founder/CEO, and team have that in spades.

Jack was CIO at 2 multi-billion medical groups (ChenMed and Springfield) and led teams of 300 people across product, engineering, and AI. At ChenMed, he rebuilt the financial claims system from the ground-up. Similarly, at Springfield, he rebuilt the operational P&L for every single department with a data engineering focus. His experience is necessary to deeply understand the nuanced workflows for healthcare FPA in practice beyond an excel model and board room. Jack is a data-driven practice leader that represents how provider-focused FPA will evolve over the next 3-5 years. He knows provider workflows and challenges intimately, which is exactly the user experience we gravitate towards in founders.

Jack is joined by Max Jones (Co-Founder, COO) and Anca Marinescu (Head of Product).

Max brings deep healthcare domain expertise and operational discipline to scaling Translucent across enterprises. At prior roles in consulting (Deloitte) and as an healthcare investor (Redesign), he saw firsthand the financial pain points of provider organizations.

Anca has an extensive healthcare background spanning product and clinical research roles at Flatiron, Elysium Health, and HSS. At Flatiron, Anca was a distinguished AI/ML product leader who scaled her product line from $0 to $60M ARR.

Why Now: Going Beyond Simple Cost Reduction

## Why Now

Any investment must have a clear and resounding ‘Why Now?’. Hospitals are facing increasing profitability pressures and regulatory changes, forcing CFOs to adapt. AI provides an opportunity to empower non-super users - the healthcare operators on the ground - to access financial analysis for all departments and service lines 24/7.

- Profitability Pressures. Healthcare providers have always had low operating margins margins (2-5%), but efforts to improve margins are becoming increasingly challenging. Provider organizations now have to juggle many issues, including persistent economic and inflation pressures, workforce struggles, evolving utilization trends, increasing competition, and supply chain problems. Health system operating margins largely recovered following sizable volatility in recent years, but expenses continue to rise across the board (11%+ over last 2 years). At the same time, hospitals’ expense have been met with inadequate increases in reimbursement by government payers and increasing administrative burden due to inappropriate commercial health insurer practices.

- Regulatory Tailwinds: The OBBB. Signed on July 4 2025, the One Big Beautiful Bill (OBBB) reshapes the economics of U.S. hospitals and amplifies demand for real-time financial intelligence. $793B Medicaid cuts and $268B in ACA marketplace cuts over the next 10 years could lead to 11M more uninsured and 1-3% EBITDA headwinds. Increased price transparency, a push to site-neutral payments, and ongoing scrutiny of the 340B program, amongst other reasons, have potential to compress hospital operating margins even more so.

- CFO Mentality Shifting. CFO mentality is shifting from blanket cost-cuts to more precise profitability. Traditionally, health care finance leaders have relied on cost reduction as the primary strategy to boost profitability. Labor constitutes 50-60% of expenses for healthcare providers, so there is only so much value to squeeze from blunt expense cuts. Deloitte’s 2025 U.S. Health-Care CFO Survey shows 73 % of finance leaders rank revenue growth and operating-margin expansion as their top worry, while traditional cost-reduction has fallen out of the top three priorities for the first time since 2020.

- Advancements in LLMs for FPA and Structured Data. Advancements in LLMs over the last 12 months, particularly with structured data (text-to-SQL, coding Python scripts, RAG, and agentic frameworks, etc), have made it possible to build AI FPA solutions with the accuracy and performance required for real-world use. As an example, Text-to-SQL answers correctly 98% of the time on open-source benchmarks today, a massive improvement from ~75% in 2023. In the real-world working with enterprise data, prompting the best LLMs and using agent-based methods hit a ceiling at 85% accuracy. Fine-tuning open-weight LLMs on business-specific query-SQL pairs gave 95% accuracy, reduced response times to under 7 seconds (by eliminating failure recovery), and simplified engineering. These examples and techniques have already been tested in other industries, which give Translucent a playbook and framework in healthcare. At the same time, this data shows how healthcare-specific expertise (e.g., understanding data schemas, the questions people will ask, and ideal outputs) improves performance of these systems.

Vertical Healthcare AI: Investment Framework

##Vertical Healthcare AI

At Virtue we’ve invested in teams across healthcare and life sciences thats are leveraging AI/ML through clever user-centric design that drive significant system-wide productivity enhancement and yield material organizational ROI. Healthcare inucmbents have been a historical laggard of tech adoption, but times are changing fast. Select AI native healthcare builds are growing and being adopted at unprecedented rates.

We bias towards those AI-native healthcare companies that show the early potential to create a virtuous cycle: deep domain expertise informs intuitive product design, enabling effective distribution strategies, which then generate valuable data assets that reinforce the product's competitive edge.

💡 Domain-Specific Expertise → Distribution → Data Advantages

The domain expertise of the founders should be encoded in LLM-based reasoning, automations, and agentic workflows (founders are the first human in the loop!). Distribution should drive GTM strategies and business models enabled by new capabilities with AI (ease/speed of integration, new pricing models, land-and-expand with multiple agents, etc). Over time, this distribution creates a sticky customer base that can generate data for context engineering (not just supervised fine-tuning or RLHF) to improve the product over time.

Translucent embodies this virtuous cycle:

- Domain Specific Expertise. The Translucent team has a deep understanding of the healthcare data and calculations that underpin strategic FPA work. Translucent is systematically capturing "tribal knowledge" from their customers - the unwritten rules, best practices, and analytical approaches that experienced healthcare finance professionals apply intuitively but aren’t documented. The Translucent team leverages their prior experience and works directly with customer FPA teams to codify rules in LLM-based workflow, such as: "When analyzing CPT code performance in ASCs, prioritize non drug / testing codes and surface those codes that are high-priority for the service line”

- Clear User-Buyer Distribution & Immediate ROI. Translucent’s chat-based UI drives adoption across an entirely new user type that doesn’t need to know complex excel calculations or SQL. This approach creates internal champions, drives adoption of more agents as ROI is proven out, and increases internal utilization of platform (users today are using Translucent daily). In addition, Translucent can land with a single agent or multiple agents (e.g., specific service line agents, P&L Agent, physician compensation, etc) that can be implemented in 4-6 weeks to provide immediate value to customers.

- Data Flywheel. Translucent's platform creates powerful network effects where each customer interaction enriches its collective knowledge base. The platform accumulates experience across multiple deployments, with agents becoming more effective as they handle more queries across diverse healthcare organizations. When a physician productivity agent discovers a novel correlation between scheduling intervals and procedure efficiency at one medical group, that insight is encoded into the platform's knowledge base and becomes available to all productivity agents across their network.

Virtue Portfolio Case Study — SmarterDx: Translucent has the potential to run a similar playbook to one of our earliest and most successful investments, SmarterDx. SmarterDx is focused on clinical documentation integrity (CDI) and leverages AI to analyze 100% of patient charts to capture missing and incorrect diagnoses, resulting in $2.5M in annual net new revenue per 10K patient discharges. SmarterDx co-founders Michael Gao and Josh Geleris encoded their domain-specific expertise in proprietary labels which SmarterDx created based on M.E.A.T. criteria (e.g., how a physician conducts a differential diagnosis). They built on top of this domain expertise and leveraged a business model (contingency fee as % of additional revenues) and GTM strategy (historical audits, no EMR integration required) that aligned multi-stakeholder incentives and required little-to-no change in workflow. Over time, the data from each health system customer improved the sensitivity and specificity of prioritizing and identifying patient charts for CDI pre-bill and led to new product releases (e.g. claims denials). SmarterDx solved a true ‘hair on fire’ problem for their hospital clients which led to truly rapid adoption over the last 3+ years as one of the fastest growing VC-backed digital health companies. We see parallels to Translucent in their early adoption, immediate enterprise ROI and quick up-sell motion in to adjacent service areas and overall strong market pull catalyzed by technological and regulatory tailwinds.

Next Steps

## Next Steps

Translucent is already powering workflows tied to hundreds of millions of dollars in revenue for its customers and rapidly expanding its client base.

If you’re a health system or medical group looking to improve financial performance, reach out to Jack (jack.ohara@translucent.co) or schedule a demo!